Riverside Commercial Solar Tax Credits

Businesses in Riverside County may be eligible for the 10% Energy Community tax credit adder thanks to the Inflation Reduction Act passed by the Biden Administration in 2022.

The Internal Revenue Service added 446 more US counties last month to the list of counties where renewable energy projects qualify potentially for a 10% energy community bonus tax credit!

The 446 counties are in statistical areas that the IRS identifies as potential energy communities. Not all of the 446 qualify for the bonus credit currently. Locations must check two boxes to qualify.

The Treasury said 122 of the 446 qualify as energy communities for the period January 2023 through late May 2024 when the Internal Revenue Service is expected to update the qualification tables. Those 122 counties check both boxes currently.

The IRS made the announcement in Notice 2024-30. A table with the 446 new counties can be found here. The list of 122 that qualify currently can be found here.

More details about energy community bonus credits can be found here.

Eligible Projects

A project on which an investment tax credit will be claimed qualifies for an energy community bonus credit if it is in an energy community when the project is placed in service.

Qualification can be locked in by starting construction for tax purposes when the location qualifies. Construction cannot have started before 2023.

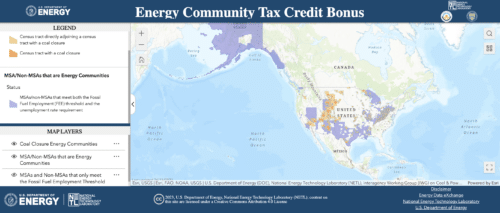

Three types of areas qualify potentially as energy communities. They are:

- brownfield sites,

- census tracts (and adjoining tracts) where a coal mine closed after 1999 or a coal-fired generating unit closed after 2009, or

- statistical areas that had at least 0.17% direct employment in oil, natural gas or coal at any time after 2009 and had a local unemployment rate the year before the qualification year at least as high as the national rate. For example, an area with higher local unemployment than the national rate in 2022 qualified potentially as an energy community in 2023.

The latest IRS announcement of additional potentially qualifying counties affects areas that are in category 3.

Additional Counties

The IRS increased the number of counties that qualify potentially as eligible statistical areas by adding two more categories of workers it considers directly employed in oil, natural gas or coal.

The additional workers are employees of local gas distribution companies and construction workers on oil and gas pipeline projects and related structures. Every county has a local gas distribution company.

The local unemployment rate must be at least at high as the national rate to check the second box and capitalize on the potential eligibility.

Contact Us

Want to minimize your organization’s Federal tax liability through Federal tax credits and commercial solar panel depreciation: https://www.beachcitiessolarconsulting.com/commercial-solar-panel-depreciation/? Inquire today for a commercial solar quote through the contact us button below!

This blog provides an overview of the Federal solar investment tax credit energy community 10% adder available for businesses that own solar facilities. It does not constitute professional tax advice or other professional financial guidance and may change based on additional guidance from the Treasury Department. Please consult a licensed tax professional regarding your organizations specific situation as we are not tax advisers.