Free Solar Consultation

Subscribe to our newsletter and receive a free consultation.

By submitting this form, you are consenting to receive marketing emails from Beach Cities Solar Consulting. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, at the bottom of every email.

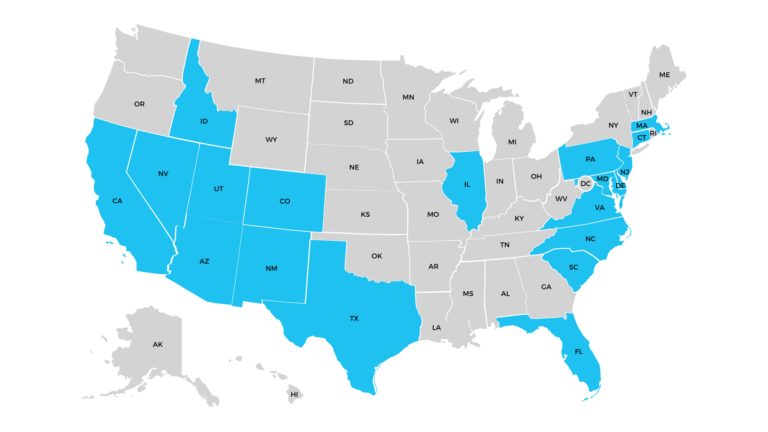

We exclusively work with Powur, PBC as our nationwide residential solar and storage installation partner.

Have Questions? We Have Answers?

No. Not for cash compensation and this program is no longer available with SCE, SDG&E, PG&E, or LADWP. However, each of these utilities offers a Net Energy Metering program whereby the excess energy your solar solution produces during the day is exported to the grid and credited against the energy you draw from the grid at night. Any excess generation that is not used in any given month rolls over for one year as a credit on your solar bill. At the end of the year, the utility will provide a “true-up” bill that will account for all energy used above and beyond what your solar solution produced.

Yes! Both residential and commercial solar installations are eligible for a Federal tax credit. For example in 2021 the Federal tax credit for solar was 22% and if your solar system installation costs $30,000, you would be eligible for a $6,600 Federal tax credit. And businesses were eligible to depreciate 85% of the gross installation cost in year one on their Federal taxes in addition to the 22% Federal Tax Credit. Please consult with your tax advisor regarding this year’s Federal Tax Credit information for your solar energy needs.

No. We offer financing options for $0 out of pocket that provide immediate savings while adding value to your home or business.

Yes. Unless you install battery storage along with your solar solution. A grid-tied solar solution will lose power when there is a blackout.

Yes. The rule of thumb is that if your roof has 5 years or less on its warranty then the re-roof should be completed with the solar installation. Doing the work together may also make your re-roof eligible for the 26% Federal Investment Tax Credit. Please consult with your tax advisor regarding your specific situation.

Yes. We will gladly install a 50 Amp Level 2 electric vehicle charging outlet for your electric vehicle. We do this at our cost.

Yes. We customize every solar solution to meet the onsite load of the home or business, including any potential improvements to the property that will increase on-site energy consumption.

Yes! We can install solar on any type of roof including Spanish clay tile, concrete tile, composition shingle, metal, or flat roofs. Older wood shake roofs are no longer up to code and must be re-roofed with a different material to go solar.

Appraisers have added line items for solar solutions in the appraisal. The increased value the solar solution adds to the property will more than offset the amount owed on the loan. When the property is in escrow, you would pay off your solar loan with the proceeds from the sale of the property just like you would with your mortgage.

No. We recommend lenders that use a UCC-1 filing to secure their loans. The loan is secured by the solar equipment and not the home. If you choose to finance your solar solution with the proceeds from your mortgage, re-finance, or home equity line of credit the lender would secure their loan with your real property.

For residential properties, it takes on average six weeks from signing the home improvement contract and utility paperwork to your solar solution being turned on by the utility (Permission To Operate). For commercial properties, the process is longer. It can take from six months to one year for the solar solution to be “commissioned” by the utility and turned on. The actual construction of the solar solution typically only takes one to three days with residential projects and two to six weeks with commercial projects.

Yes. Residential appraisers have added a line item to their appraisals for solar solutions. They will value the solar solution based on how old the equipment is and how big of an electric bill it will offset. In general, for residential properties, the solar solution will add about two times its installation cost to the property’s value. Commercial valuations can vary greatly depending on if the solar solution is offsetting the tenant’s electric bill or the property owners. In the case of the former, the solar solution increases the cash flow of the property, thus increasing the value of the underlying property.

For residential properties, we can back up your critical loads (lights, refrigerator, outlets, etc.) with one, two, or three batteries. These critical loads will continue to operate in a blackout and anything that was not backed up with the batteries will lose power. For commercial properties, businesses can stack several batteries together depending upon their needs. Many businesses are installing batteries to reduce their commercial demand charges, which can be up to half of the bill for a business that uses a lot of energy in a short period of time (measured in 15-minute intervals).

Yes. Battery storage is eligible for a Federal Investment Tax Credit when paired with a solar solution. Depending on your location, there could also be a one-time cash rebate for battery storage (that is subject to exhaustion). The rebate is based on the size of your battery storage system. Businesses are also eligible to depreciate the battery storage system as a business expense. We will include any tax credits, rebates, and incentives in your custom solar and storage

proposal.

Yes. We offer both residential and commercial solar and storage financing with $0 out of pocket!