With the cost of solar panels plummeting by 70% over the past 10 years, there has never been a better time to invest in a commercial solar project! The U.S. Congress also just passed legislation to extend the current 26% Federal tax credit for an additional two years to December 31st, 2022.

So, how much does it cost a California business to build a commercial solar project?

Well, that all depends on how much energy the business is consuming and how much available roof space (or vacant land) the business has available to install solar panels on. Let us look at an example to dig deeper into the numbers.

If we look at a business in Torrance, California with a 50,000 square foot facility this business can install roughly 1,272 solar panels (a 502 KW solar system) and save $80,248 per year on their electricity costs. The cost of this 502 KW solar system is $903,600 and includes all engineering plans, procurement of materials, and construction of the business solar system. This is an all-in turnkey price meaning the city permit, taxes, and interconnection to the electric grid are included.

If you want to determine the Return on Investment (ROI) for this project we would deduct the 26% Federal Investment Tax Credit of $234,936 from the solar system’s gross cost of $903,600 bringing the net investment to $668,664. The business-owned solar system would also be eligible for Federal depreciation in the amount of $235,839 (assuming a 30% Federal tax rate) in year one.

In addition to the Federal deprecation, the business can also depreciate the solar system for state tax purposes in the amount of $86,474 (assuming 11% California tax rate) over five years. After subtracting out the Federal and State depreciation ($322,313) the net cost in the solar system is $346,351. This solar system will save the business $80,248 per year so if we divide those savings by the net cost of $346,351, we get a payback period (or ROI) of 4.31 years! Of course, we are not factoring in any inflation rate for the utility rate increases, which would make the ROI even shorter. I am not a CPA and do not provide tax advice so please check with your tax adviser for your business’ particular situation. These figures are from a project I consulted on for a large corporation in Southern California.

Can you finance commercial solar projects?

There are two options for this scenario. The first, PACE financing. PACE financing or Property Assessed Clean Energy is a financing method whereby the city or county property tax assessor attaches a lien to the property of the business and adds the financing costs to the annual property taxes. If the municipality has approved this form of financing in your city and the property has equity the business may tap this equity without using any existing credit lines to facilitate the construction of the solar project. This can be very advantageous to the business because the annual energy savings will be more than the annual financing cost! This strategy allows for businesses to go solar and reduce operating costs without spending a dime from their operating cash flows. In addition, if your tax adviser allows it, the business may be able to deduct the financing cost as part of the property taxes allowing for additional tax savings (again please check with your tax adviser as I am not a CPA, but this is a common strategy I have seen many businesses use).

A Business Solar Installation I consulted on for Remax Estate Properties in Torrance, CA that used PACE financing to fund the solar project.

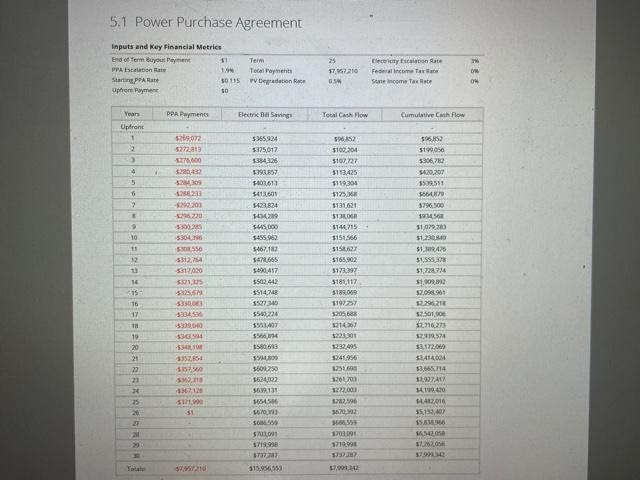

The second option for commercial solar project financing is to procure a Power Purchase Agreement (PPA)

In a PPA, a third-party investor will own and operate the solar system on your roof or property and sell the solar energy that is produced to the business at a fixed price for 25 years (typically with a fixed inflation rate built in). This fixed price is always less than what the utility charges providing for immediate savings to the business (typically 10-15%) with no capital investment (capex). The investor covers all operations and maintenance expenses of the solar system for the duration of the PPA contract. In this scenario, the investor makes money by receiving all the Federal tax credits, state depreciation, and a twenty-five-year income stream from owning the solar system. The business wins from lower energy costs with no capex investment. The Earth wins from less fossil fuels and carbon emissions!

An example of a Power Purchase Agreement where the business does not own the solar system but benefits from immediate energy savings (shown in the 3rd column). Total savings for this business over the life of the PPA are $7,999,342!

Now that you know how much your business solar system will cost let us talk about the workflow of these business solar projects. It typically takes about 6-12 months to complete a business solar installation. This process starts with contracting a solar installer for the project and is followed by a site audit at the business. Once the site audit has been completed the solar installer will draw up plans for the project and submit them to the city for a solar permit. All this work is done behind the scenes by the solar installer. Once the city has issued the solar permit the installer’s crew will show up at the business to install the solar system. This typically takes between two to four weeks, unless additional work needs to be done to facilitate the solar installation (examples include a solar carport or canopy, these projects take longer to build). After the business solar system has been built, the installer will call for a final inspection with the city. When the city has signed off on the final inspection, the installer will submit the job card and interconnection paperwork to your electric utility to process permission to operate (PTO) the business solar system. The electric utility will request a site test or “commissioning” of the solar system prior to interconnecting the solar system to their electric grid to verify the system is working properly. Once the solar system has been commissioned by the utility the final step in the process is when your business solar system is interconnected to the utility’s electric grid. This is called Permission To Operate (PTO) your solar system.

Regardless of the size of your business solar system, if the business is on an electric utility rate with demand charges (most large businesses are), the solar system alone will not fully eliminate your electric bill. To achieve this goal, the business will also have to install an energy storage system (ESS), which I will discuss in another blog post.

Want to see how much money you can save with a business-owned solar system or PPA?

Get your turnkey commercial solar project proposal with ROI and financing options by e-mailing us your last 12 months’ electric bills (all pages), a picture of the electrical switchgear inside of the business, and a picture of your roof today: info@beachcitiessolarconsulting.com.