California Home solar loans have enabled the mass market, or average California homeowner, to go solar. Prior to California home solar loans only the rich could go solar. Now every homeowner in the state of California can benefit financially from going solar and help our planet transition off fossil fuels!

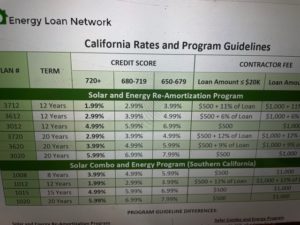

ELN California Home Solar Loan Rates

Here is how a California home solar loan works:

In a typical scenario, the home solar loan will be for 8, 12, 15, or 20 years and require $0 down payment or out of pocket. The lender will split the loan into two parts, 74% that the homeowner will make payments on for the life of the loan term and 26% that is meant to be paid off by the homeowner’s Federal tax credit. By using this “split loan” strategy the homeowner can save money immediately while not paying a dime out of pocket for their solar installation. Keep in mind that in these split loans if the lender does not receive the Federal tax credit from the homeowner within the specified grace period (typically 18 months) the loan will re-amortize on the full outstanding amount of both loans owed. The loan type we are discussing above is called a UCC-1 loan, which is secured by the solar equipment and not the home itself.

Although there are other forms of solar loans that are secured with real property, a UCC-1 loan is by far the safest for the homeowner because in a worst-case scenario, if the homeowner defaults on the loan, the lender’s only form of recourse is to take the solar equipment, and not the home itself.

While these loans are a wonderful thing for California homeowners it has also created an entirely new industry, and like all for profit industries home solar loan lenders must make money, or they will be out of business.

One of the benefits of working with Beach Cities Solar Consulting LLC is that we always put our clients interests before that of our own. Most of our California home solar clients live along the California coast and have good credit and assets. For these clients, using a home equity line of credit or cash out re-finance to purchase their home solar system in cash makes a lot of financial sense (as these options provide low interest rates and the potential for additional tax savings). For our clients who would rather keep those lines of credit for other purposes, we recommend Energy Loan Network (Los Angeles Federal Credit Union). Unlike many home solar lenders, ELN only charges a $1,000 origination fee on their California home solar combo loans. Unfortunately, many of our competitors in the marketplace are recommending home solar loans with extremely low interest rates that come with origination fees as high as 25 percent! With an average home solar and battery system cost of $30,000 – $50,000 this can lead to an additional $7,500 – $10,000 paid in fees to the home solar lender.

It is always important as a California homeowner to compare the total amount paid throughout the loan term and not just the loan payment or interest rate. By comparing the total amount paid over the lifetime of the loan you can determine the actual cost of financing your home solar system.

Want to see how much money you can save with a home solar panel and solar battery system? Get your turnkey California home solar panel and solar battery proposal with ROI and financing options by e-mailing us your most recent electric bill (all pages), a picture of the electrical panel outside your home, and a picture of your roof today: info@beachcitiessolarconsulting.com